Maybe I'm too self-centered.

Let's just get in to it.

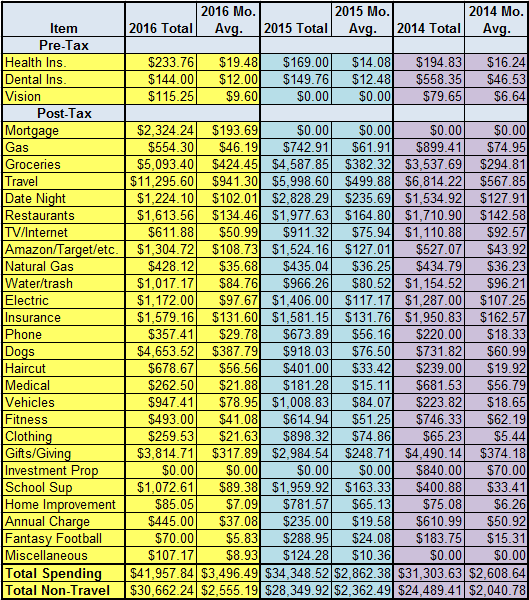

Here are the numbers in all their spreadsheet glory. Click for bigness.

Summary:

- Our total spending jumped all the way up to $41,957. This probably seems like a very normal amount for a couple without kids to spend to the average person in America. But in the Financial Independence, Early Retirement community, spending forty two grand makes us something like Scrooge McDuck asking Mindy Kaling to light his cigar with paper money.

- How the hell did this happen? Thanks to our trips to Africa in the summer, and Asia in the winter, and, whoops, paying for things from our upcoming trip to Europe ahead of time, our travel spending ballooned to $11,295. This is way above our goal of only $5,000 a year for travel. But when you want to see new parts of the world, maybe there are better places to find savings.

- Our pup spending also reached a new record: $4,653. A lot of this was unavoidable, as our last puppy, Pepper, came down with valley fever that took a lot of tests to diagnose. And when she passed, and we got our new dog, Cayenne, there were a lot of new costs with her, too. But I think we'll see a good reduction in 2017.

- The real shocker came in groceries. We spent a ludicrous $5,093 at the grocery store this year (averaging $424 a month). I suppose the average looks a lot better than the gross amount, but that's still a lot. I suspect the culprit is beer, which we try to bring when we go to a friends' house or host, which happens a few times a week. And we're eating fancier food than we probably need to, thanks to Joule and ChefSteps. I should want to trim this figure down, but I like eating good food and drinking good beer. Maybe I'll just need a side gig.

This is how.

And here's the multi-year view on The Mad Fientist's laboratory:

|

| December was out of control... |

The big problem for 2016 was that we crept above the $40,000 spending limit outlined in our financial independence/early retirement plan. We're violating the 4% rule for our hypothetical, future nest egg, and we're doing it without our future kids or our future, bigger mortgage.

This can partially be explained away by simply taking out our travel budget. Once you take that out, we're at a reasonable $31k or so for the year, and at a fairly acceptable increase over the 2015 non-travel spending.

But this would be fudging the numbers to to make them do what I want. Even if we cut travel out of our plans going forward (we don't want to), I figure a couple kids are going to cost as much as a couple international vacations each year.

And what about that mortgage on the new house we're planning to buy? Even as the move will increase our invested funds, it will also add about $10,000 to our annual expenses.

Next Steps

The bottom line is that we've become less frugal over the past year or more. I generally think this is fine. I like all the things that have increased our spending: we enjoy going abroad, and eating good food from the grocery store, and drinking hoppy beer with friends, and taking our pets to the vet if we think they need to go, without trying to pinch pennies.

But the math is the math. For our early retirement plan to work, we either need to spend less (even as we get a bigger mortgage and a bigger family) or we need to save a bigger nest egg, which takes time or a bigger (or second) income.

Just like Tina Fey, I don't want to give anything up. I want to have it all: the modest but still somewhat spendy lifestyle, and the new home, and a couple kids running around in the backyard, and an early retirement at the envious age of forty.

So, in 2017, my challenge to myself is to get all the things I want, but to get them for less money. I'm going to make up with my old friend, frugality, who I've chastised and mocked for a while. I'll give Costco a chance again, even if going on a weekend happens to be the worst shopping experience in America. I'll come up with creative ways to get our spending under forty thousand, without shortchanging our pets, or our home, or our food. Oh, and we'll do it with a new mortgage, too.

I have no idea if this is an easy goal, or an overly-ambitious one. But I've got all year to find out.

To my frugal friends, please teach me again in the comments below. How can we live well for less?

*Photo is from Jedimentat44 at Flickr Creative Commons.

*Photo is from Jedimentat44 at Flickr Creative Commons.

I just realized I spent around 60k, ON JUST ME, and I didn't really do that much expensive traveling last year. I hope that makes you feel just a tiny bit better? I'm going to go weep now and what you're paying for your mortgage versus what I'm paying in rent...

ReplyDeleteIt really is all relative, and we all are going to have outlier months and years in our spending, I figure.

DeleteI should note that the mortgage's first payment was in September, so the annual figure is only like 1/3 of what it would be annualized. It's $600 a month...though being from Southern CA I know that's probably cold comfort to see.

Wow, that's a lot of spending. I personally never spent more than $20K for myself only. However this year was an year of adjustment for me, as we are combining two budgets with the better half in one and had some large health bills.

ReplyDeleteOn the other hand, I would imagine that you won't be spending $4,500 at the vet every year going forward.

Your mortgage expenses for 2016 were super low. But using your new mortgage assumptions, you may be spending more money in 2017.

On the other hand, do you think Travel will be as expensive in 2017? Have you finalized your plans for the year?

Good luck in your FI journey!

DGI

I hear you, it really is a lot. We average about $17k per person a year, but this year we jumped all the way up to $21k/per person.

DeleteFor travel, yeah, I anticipate we'll spend about $5 or $6k for a portion of our Asia trip, and the upcoming trip to Northern Europe. We'll see when we tally up all the expenses though.

The mortgage expenses are for only a portion of the year -- but it's about $600 per month currently. It'll go up to about $1,500 a month when we move, roughly (and we'll have about six figures more invested in the market to mitigate the costs).

Anyway, thanks for reading and the comments!

Your frugality skills are overrated. This is bigly disappointing. SAD!

ReplyDeleteI'm always a little envious of those living in lower cost of living areas. This budget looks awesome to me.

"DoneByForty is a fake early retirement site. This guy isn't even trying to be a billionaire like me. Sad!"

DeleteI hear you, Andrew. The lower COL areas do skew the numbers quite a lot. I personally feel we're playing FIRE on easy mode, since Phoenix has such cheap real estate, I have a work-from-home job with a salary that's set by an employer in another, higher COL state, groceries aren't taxed, property taxes are like $800 a year...

Anyway, we probably should be doing a bit better than we are.

Go solar to save on electric

ReplyDeleteCut back on the fancy haircuts (every other month?)

Order healthier vegetarian entrees at restaurants, when they're cheaper.

And most importantly... start winning $ in Fantasy Football

Ha! I've actually won our fantasy league three years running, so we're over two grand in the black over the time period shown here. But I keep all our saving/investment figures separate from these posts.

DeleteLove the idea to cut back on haircuts. I pay about $25 a month, and Mrs. Done by Forty will have her hair cut/colored a few times a year. We probably both could find some savings there.

Vegetarian meals are a rare commodity in our home. Maybe that's the ticket for some big savings, as we're talking thousands a year instead of hundreds, like the other two items.

I think your expense is reasonable. It's really hard to live frugally forever. It's better to get to a comfortable spot (moderately frugal) and keep it there.

ReplyDelete$42k/year isn't bad, but it looks like it will increase quite a bit in the future. I'd say shoot for a bigger nest egg. Good luck!

Thanks, Joe. The bigger nest egg might be the ticket (or, I suppose, paying off the mortgage when we finally pull the trigger on ER?).

DeleteAs you noted, it's hard to be frugal forever but maybe the inevitable lifestyle creep can be countered with renewals/bursts of frugality.

Ha! Sounds not too dissimilar from our year where we had pretty extensive travel (~$9K! and luckily we don't want a repeat) and Mr PoP also got a Joule at the end of the year.

ReplyDeleteFWIW, Mr PoP has definitely been eating more meat with the Joule, but it doesn't seem to have affected our grocery budget too much as we're experimenting buying cheaper (loss leader) cuts of meat. Apparently Mr PoP now thinks that $0.99/lb frozen turkey breast is pretty freaking good when you cook it with the Joule. And as a bonus he used the bones and meat left on them to make turkey soup. Way better $-value than our previous occasional purchases of NY strip steak or boneless chicken breasts (some of the only meat we really knew how to cook), even if we were buying those on sale.

Yes! Joule is the best. I just bought a big chuck roast to cook sous vide for a day. :)

DeleteI'll have to check out that turkey breast recipe. Is it on Chef Steps, or do you have another recipe you like?

Actually, I don't think your grocery spending looks all that bad. I'm quite sure I spent more than half of that on just me, though at the moment I'm too lazy to add it up.

ReplyDeleteBut I keep getting a vibe from you that you're having a bit of an existential crisis as far as frugal living goes. Maybe you need to take a step back and analyze the bigger picture, rather than just obsessing about the numbers and beating yourself up trying to do better.

I mean, ideally, this shouldn't be about suffering or trying to cram yourself into a box that you don't want to go into - it's about freeing yourself from habits and norms that aren't really that fulfilling, so you can focus your time and money on those that are.

There's this accepted idea in our society that spending money equals fun and happy, while not spending is sad and difficult. In reality my experience is that very often this just isn't the way it works, though I still fall into that trap more often than I'm comfortable with. It's like how I'll find myself at a party eating potato chips or chocolate ice cream because they're both things that are "supposed" to taste good, and part of my brain says, "Go ahead, treat yourself!" Of course, only after I've eaten a bunch of crap and don't feel at all satisfied do I remember that I really don't like either potato chips or chocolate ice cream, I just like the idea of treating myself!

I'm rambling... as usual. Just thinking that maybe the old YMOYL exercise is in order. In other words, add up each expense and calculate how many hours of your life went into it, then honestly evaluate how much happiness it brought you and make some decisions from there.

... or you could just develop severe motion sickness, giving you horrible migraines when you travel, and voila! $12K/year saved! :-)

I hear you, EcoCatLady. You always leave such good comments.

DeleteI think the rub is that I'm not naturally frugal. I have the fervor of the newly initiated, which wears off and needs to be renewed. I suspect that I'll never effortlessly resist the temptation to spend, as other FIRE bloggers seem to. (Though, and this is a real possibility, maybe they're also in the same boat and are better at projecting an image of effortless, enthusiastic frugality.)

I hear what you're saying about our belief that consumerism = happiness. I've often bought in to this (Good beer makes for a good hangout, right?) but see the other side of the argument, too: that it's okay to spend money, maybe a lot of money, to do the things you actually enjoy.

I haven't cracked open YMOYL in a while (though I did see a copy on Annette Benning's car seat recently in American Beauty, which was a TRIP). Maybe it's time to step back and re-evaluate, like you said.

I totally agree that it's OK to spend money on things you enjoy. Heck, my bike is worth more than my car! (Which may actually say more about my car than my bike, but you get the idea.) I think it can sometimes be hard to distinguish between enjoyment and status though... at least it is for me.

DeleteAnyhow I never noticed that scene in American Beauty (one of my favorite films) - somehow Benning's character seems like an odd candidate for that book. Wonder if the producers even read it or if they just liked the title.

OK - just had another thought that I figured I'd share. For me the turning point with frugality came when I stopped equating spending money with "treating myself" and started to see it as "robbing from my future." I remember it clear as day - I was having an argument with myself about buying something. Part of me was saying "I want it" and part of me was saying "you shouldn't be wasteful."

DeleteThen suddenly I realized that it wasn't about whether or not I was allowed to have the thing, it was a choice - which do I want more... the thing or the freedom that comes from having money in the bank? From that point on, my thinking totally changed and frugality became much less of a struggle. Of course, key to the whole thing was finding non-spending ways to treat myself... like spending an hour soaking in a hot bath on a cold winter night, or sitting in a sunbeam with my cat, or staying up late to watch a movie because I feel like it, or going for a walk in the park just because.

Again... sorry to blather, but I hope that helps. big hugs! :-)

Enjoyment and status get conflated all the time in my mind. Both give off a lot of good feelings, and a lot of the time they come in the same package. I get the feeling that's why stoicism is so popular with ER bloggers: it tries to strip out the emotion from these decisions.

DeleteI do like the reframing you put on spending: spending is not the only way to treat yourself, and it does "rob your future". But, and maybe this is just my own consumerism speaking, I think that is a tough way to look at spending: as something in the present should generally be passed over, in favor of a better future. Which of course is true and that's the whole driver for FI...but I'd like to be able to do that while still making space to really enjoy the present.

As you said, maybe the happy middle ground is really treating yourself in a way that doesn't cost a lot now. Finding new ways to enjoy life right now, in a way that doesn't set 'future Brian' back.

Or... if not passing over something you really want now, at least ferreting out the things you really want vs. the things you just think you want. In my case, it was the act of buying something for myself that felt good - not the actual having of the thing. So once I figured that out it was pretty easy to let go of my little shopping habit.

DeleteBut I absolutely do NOT think that one should suffer now for the sake of enjoying life later... that's just putting yourself into a box that's doomed to fail. It's like trying to diet on pure willpower so you don't end up with diabetes in the future... it never works. You've got to eat healthy food because it makes you feel good in the present - the future is just gravy.

So the trick is to find a place where your current level of spending both feels good now and lays the groundwork for a better future. And if that means being a little less frugal, so be it. You don't have to prove anything to anyone... it's not a success vs. failure thing, it's just about making your life better.

I hear you. I was probably reading too much in to "robbing your future" phrase.

DeleteI do want to find a good equilibrium for spending and saving. The goal of retiring by 40 is motivating but it's also a bit constricting: it's a very public goal that's frankly a bit in jeopardy. We'll see.

EcoCatLady nailed it. I enjoy woodworking, an innocent enough hobby, but I buy some tools occasionally and definitely need to buy wood, screws, glue and nails on a regular basis. I don't know what I'd do with my extra time in the evenings if I didn't have something to tinker with so although it comes with an expense, I'm still SAVING one heck of a lot of money no matter this small amount I'm spending to tinker with wood. That is what I have to keep in mind, how much I'm still saving in relationship to my spending. Personally I think it is ridiculous for a couple making 350k annually to spend 40k annually. If they are saving 50% of that annually, they are probably doing better than 95% of all others making the same.

DeleteI honestly don't know what people who have super low budgets do with their time. Doing things involves spending money. I don't want to sit in my house watching TV or surfing the net all evening and I don't want to exercise all evening everyday either.

Remember when it was revealed that MMM was making 400k on his blog and he maintained that he still lived on 24k annually. I never really trusted everything he said, but this took the cake. To claim one lives on 24k a year and vacations with other families to save money while making 400k is just fraudulent and ridiculous on so many levels.

On second thought, while working in the garage, if you are practicing to spend 4% that is another story.

DeleteFrankly I think people should think of their stash as F-U money rather than early retirement since it seems few have the nerve to retire early once they've hit the magic number. Shooting for the number for over a decade or even 2 decades and when they hit it all the doubt in the world hits them it seems.

If you get a cat instead of the dogs, cut the travel in half and drop the gifts category somewhat you'd be back down near 30K so I don't think it's that bad.

ReplyDeleteYep! There's definite slack in the budget. My goal, for now (though EcoCatLady has me wondering if it's the right goal) is to get our bigger mortgage but still come in under $40k, using some of those tips you suggested. Our travel is the obvious cut, and it's really inflated by spending a lot on things for a 2017 trip in 2016 (like paying a grand for a van to drive around Iceland's ring road.)

DeleteUmmm... trust me guys, you can spend WAY more than $4.5K/year on medical expenses for a cat!

DeleteI know it! Cats have all the same financial risks as a dog.

DeleteWe did better in 2016 than we did in 2014 and 2015. But I'd still like us to go lower. Don't give up the dog. Too cute. :-)

ReplyDeleteWe'd give up the house before we gave up the pup.

DeleteI'm glad you did better in 2016. I'm going to dive into your site for food saving tips. :)

I read your blog because I admire your goals, your methods, and your general thinking, but deep down I know that your path is not my path to FI.

ReplyDeleteIt's nice to learn lessons about how I *should* improve our spending and budgeting, and to some extent we do make adjustments. That being said, my wife and I have come to the conclusion that our personal path to FI is through the revenue side. Maybe we're lucky. We're both well compensated and pretty good at what we do, so it gives us flexibility as we try to out-earn our costs. Also, the tax advantages of owning a revenue making self employment company are significant and comprise a second pillar to our income model. Net net, totally out of whack with typical FIRE thinking, our model is:

1) Use high paying double income to increase our revenue faster than our costs.

2) Leverage significant sole proprietorship income tax advantages to facilitate lifestyle and goose retirement plans.

3) Invest in break even or better real estate in good school districts in booming city (Seattle). Rent them.

4) Minimize extraneous spending.

I realize that that is back asswards and things would move even faster if we tightened up on #4, but it's just how we're operating.

By the way, this probably deserves it's own blog post, but it seems to me that the number one most important financial choice one makes in your life is your choice of spouse. I'm a romantic myself and I realize that that isn't a very romantic statement, but it is 1000% true. I happened to choose wisely (a good earner with a reluctance to overspend) but there were plenty who came before her that would have led me down an entirely different path. Whew!

That will be one of those nuggets I will pass down to my son. Marry your equal or better, do not marry down. I see a lot of men get this wrong and it costs them (maybe they're intimidated by smart women or something).

So many good thoughts there.

DeleteFor what it's worth, the actual amount you spend is fairly immaterial (if you ignore the punitive income taxes on top earners): what matters is the savings rate, the ratio of what you earn to what you save (or rather, invest). So if you're spending six figures, but investing 4x that amount, who cares? You're doing as well as anyone else with an 80% savings rate.

I like your advice to your son, but I have to wonder, what if you had a daughter? If men should marry up, what does that mean for the women in our lives? ;)

Yes, I've given thought to the daughter thing too. I would tell her "don't marry an ahole" and also "don't marry a leech". In short, she should marry equal/up also...and education level is generally a good starting point, followed by "is he a jerk".

DeleteOf course, that begs the question, "but if everyone followed your model Tin, no one would get married except equals because everyone would be looking for someone equal or up, how do you account for that?". The answer is, I don't account for it, as there are plenty of people who won't follow my model regardless.

Agreed. The best advice can still be the best, even if it cannot be applied universally.

DeleteWe're not engineering society here...we're keeping our progeny away from bad people. :)

I like Tin's ideas. My wife and I were recently at the beach browsing shops where blouses with holes in them (the fashion) were selling for 60 dollars and bathing suits were 160 dollars and she said "I won't buy a dress that costs more than 15 dollars." I was shocked. I knew she was frugal, but not that frugal.

DeleteI am living an alternative to the traditional FIRE, more of a 'step' approach. We stepped down 25% this year (hours and pay) and plan another 25% in another decade. As the investments are paid off (the house gets paid off this year) we can afford to work less but keep enough money coming in to cover bills plus investments, etc.

ReplyDeleteMaybe STEPing down would be a better option for you if you have a hard time with Lifestyle creep. Even a small amount of income will make a huge difference long term.

FWIW, our expenses came right in at 30,000 and we manage that pretty easily but a LOT of our friends would struggle with this and probably be unhappy here long term.

I like that idea of stepping down: maybe when we actually hit our target investment number, that might be a good option.

DeleteAnd kudos for that $30k figure! Is that inclusive of your mortgage/rent? Either way, I'm impressed!

It's inclusive of the mortgage but doesn't include our savings or investments (we are doing some work on the house that will improve it's equity and that number isn't here either(which immediately makes it sound as if we spend oodles on remodeling that I hid from my numbers but that's not the case)).

DeleteAnd it's a bit of a cheat because we put down nearly 50% of the current house sale so the mortgage is a lot lower than most to begin with, then we did a 5/1 Arm at 2.75% so the payment is very low regardless.

Finally, it's just the two of us, no kids and we both grew up without a lot so we are feeling pretty flush with cash.

As a final thought, I think a lot of people do the step down, but in reverse. They retire full time, then many of us slowly ease back into the market (often with a correspondingly reduced pay after a few years). I'd rather ease out which maintains resume continuity, etc.

Delete"I figure a couple kids are going to cost as much as a couple international vacations each year."

ReplyDeleteAhh...but you forgot about child tax benefits...Jeremy from gocurrycracker says he actually ended up making money as a result. YAY! Free money!

And travel costs get rolled into your day-to-day spending once you retire. I do agree that 11,000 is a bit high for vacation costs, BUT, it is a variable cost and not fixed, so you can change it if you want. Plus, when you retire, you get better details because you can do long term travel, which ends up spreading out the daily costs.

So I wouldn't worry too much about it. As long as you are diligently tracking, making a few mistakes here and there won't be a problem. You just end up making up for it the following year by earning more or spending less. No biggy.

Paint me skeptical, but I doubt even most frugal parents come out ahead financially when having kids, if only due to the healthcare premiums and costs. I have a lot of admiration for those leveraging global arbitrage and trotting around our little planet, but such outliers, who are great for motivating and serving as examples for stories, are often poor examples to serve as a benchmark.

DeleteThe travel is clearly the big culprit this year, but it's an outlier, too. Most years we are in the $6k range or so. My very rough guess is that we'll shift that $6k towards extra kid costs like insurance, a little extra food, supplies, etc.

And your last paragraph is the key: just keep tracking, and adjust as we go. I'm hoping to come in under that figure but up our lifestyle a bit (bigger, newer house).

I also am highly skeptical of any savings with kids. Sounds like a nice click bait piece but unless you're putting them under the stairs and feeding them break and water, the economics don't really work. ;-). The only way to maybe finagle a financial model that would work that I've ever been able to think of is to model your elderly years where you get to live with them instead of living in a home.

DeleteBottom line: Kids cost you.

Bottom bottom line: But they're worth it.

Good summary there, Tin. I think they'll be worth it, too.

Delete"Ahh...but you forgot about child tax benefits...Jeremy from gocurrycracker says he actually ended up making money as a result. YAY! Free money!"

ReplyDeleteI think I'm missing something very key in our tax strategy here because I have no idea how to finagle making money from having a child!

We're averaging closer to $26K per person a year, and I keep wondering why on earth it's so high. One reason is that one person is in entirely a separate household so that makes it really hard to cut that baseline cost of a separate dwelling, but we also spend somewhat freely on food and travel. Also childcare.

Our 2016 was bad for spending, too. I had planned to totally revamp our budget this year but uh, life and horrible neighbors happened so that's going to have a very negative effect.

Yeah, you get the AGI deduction for each one and $1k per kid if you qualify with your income under the child tax and additional child tax credit. And you may qualify for more EIC. You get to deduct their healthcare costs against your AGI if you're self employed. And their childcare costs, but you have to spend money to get that one... Far more than you can possibly make up for the other credits combined in most cases. I'm glad they have figured out a way that works for them, but my kids cost me a lot more per year than the liberal $2k estimate per child that I'm tallying up in my head. I also live in the US where costs are higher and I can actually get the services I need for my special needs kid. Well, for now I can get the services, anyways. 2017 is starting off with massive sucky things, too, now that I think about it.

DeleteBut for most American families, the tax code does not enable children to become money-earning machines. The net is negative.

Yeah that's everything I'm thinking of and we make just enough not to qualify for most of the tax credits. 2017 looks like the logical extension of 2016, unfortunately.

DeleteHi Revanche: I agree that having separate households is going to make cutting the numbers down beyond a certain point impossible. You have two rents/mortgages, two sets of utilities, etc. Sorry to hear about the neighbor situation. Maybe it's time to move! :)

DeleteFemme Frugality: yeah, I suppose if you went bare bones maybe you can take the $2k in tax credits and come out ahead. But, man, at least with the insurance I'll be buying for my kid, that's going to eat up the figure all on its own. And I assume I have to feed him, too?

Done by Forty: Alas, it IS time to move - well ahead of my lightly planned timeline. I wanted another 3-4 years to save before we committed it, so we'd have at least another $100K to put into the down payment. The whinging will continue over at my place ;)

DeleteRevanche--that sucks. There's one or two we still qualify for, and the health insurance deduction is huge, but it's still just a deduction for something I already paid for.

DeleteAnd yes, DB40, you have to feed them lol! I think you'd be hard-pressed to find any place stateside where you came out even... Even if you were the most frugal ever.

There's definitely a trade off to financial independence. I respect it, but I don't know that--with children, at least--I'd be willing to lower my standard of living too much. I lived on less than a shoestring before them. In fact, I'd like it to increase. And I don't think that makes me any less financially savvy. Just realistic about how I want to raise my family and live my life. Our spending is about the same, though we have rent that's higher than your new mortgage, kids and all their fixings. But we live in super affordable Pittsburgh--maybe in AZ our numbers would be higher.

ReplyDeleteI guess what I'm trying to say is don't feel like you have to deprive yourself of the things you love in order to fit some FI mold. It's weird outside our community, but within it I feel like there's some peer pressure or judgement if we make different life choices. If you want to buckle down and reduce lifestyle expenses permanently, mad kudos. But if you don't there's not anything inherently wrong with you.

As for frugality, which I highly endorse, it looks like the area that will have the biggest effect is travel. Since you don't have kids yet, get creative with lodging while you can. Hostels, Airbnb private rooms, cabins, huts...I used to even do trucker motels prior to children, but that was often a braver choice than huts. Once you have kids you are not going to want to our be able to do (most) of those things, though, so that is a temporary fix. I know you guys travel hack, but with that amount of spending I'm assuming you're not hitting enough bonuses to cover ALL the hotels and/or plane tickets. Another option is to work your network and stay with friends wherever they may be. Can alter itineraries a bit, but it's usually worth the savings.

I'd buy larger cases of beer and even do cans over bottles to cut back on costs. I understand you can get coupons for alcohol, too, but, alas, I live in over regulated PA so I'm not much help there.

I realize my overarching opinion on this may not be popular. Know that I'm not trying to dissuade you from your goals... Just attempting to let you know it's okay if your goals don't look the same as everyone else's. Which I know you already know. :)

First, sorry for the long delay in responding. I've read this a couple times and wanted to wait till I had some time to sit and think -- there's a lot of good stuff here.

DeleteWhat you said about not wanting to ratchet lifestyle down too much with kids makes a lot of sense to me. I mean, I'm not really that frugal myself so I can only imagine that with kids, things might only shift even more towards the "comfort" side of things.

And, yes, there's a ton of pressure within the early retirement/FI community to spend at a low level. Frugality is not just a tool for financial independence: it's esteemed as a virtue in its own right. That can be good, but we're also playing with fire (he-he) a bit, too. Why lionize a specific type of living?

I'm still trying to figure out what part of all these goals is mine, and which parts I've unwittingly taken from other bloggers, society at large, expectations from family & friends (or what I think others expect), all of that. Like you said, it's okay if my goals don't look the same as everyone else's. I suspect my problem is that I'm not 100% on all these goals just yet: that is, what happens if I'm not really done by forty? Is that perfectly okay, or is this a moment where I should buckle down and push myself, just to see if I can follow through on the goal?

I hear the existential crisis! And I will answer with the only thing I know: for me, money wasn't the answer.

DeleteThe flip side of frugality in reference to FIRE is a decently ridiculous income. Formerly, I worked in education where that was laughable. When I started working for myself and the sky was the limit, I looked at people around me and realized that I didn't want to be that obsessed with work. Yes, providing is important, but I didn't need a ludicrous income to do so... unless I wanted to do the FIRE thing.

For me, I decided other areas were worth more to me. I wanted to explore philosophy. Truth. Existential hippie and Platonic stuff that doesn't involve money at all. In order to do that and successfully raise children, even with frugality, I'd have to be okay with not working a bajillion hours a week.

I'm just now getting to the place where I feel fulfilled. Which is why I think we set goals in the first place: to revel in accomplishment. For me, reaching monetary goals only led to looking out at the next mountain peak, never truly enjoying what I accomplished.

If FIRE is what gets you there, please pursue it full-force! Push that goal and sit happy on your mountain top. I just found that the mountain I felt happy settling upon had a different modality. And there's nothing wrong with that. Either way.

You write the best comments. There's something in the water from those three rivers.

DeleteI do get the sneaking suspicion that when we reach FIRE, we will see it was just another mountain, with more on the horizon. Maybe that's okay, but it's better to understand that this goal is just that: one more accomplishment, and not a substitute for life purpose.

I think you're being too hard on yourself. Take some time to sit and reflect on what you have, in the here and now.

ReplyDeleteYou have a home.

You will have a lovely future home.

You have a wonderful, loving wife.

You will have wonderful, loving children in the future

You live in a safe place, no wars, no conflict, no 'huge' religious pressure to dress or act in a particular way. You walk the streets safely.

You have savings

You will continue to work to continue to have savings.

You eat well, many people throughout the world do not.

You travel, and you travel in sadly and comfortably.

You will continue to travel, you are very fortunate.

You have a plan for your future retirement and who cares if you go a little off piste at least you are aware of your short comings and so can adjust.

You have your health, your wife has her health.

Sadly your dog has been poorly, but remember you were in the very fortunate position to pay for her care.

You have your wits.

Be thankful. Take a deep breath and carry on as you are because you have family and friends who love you.

Sorry for rambling. We are lucky in Britain to have the NHS.

I have to apologize -- it looks like your comment got caught in the spam filter, which is a shame as it's such a nice comment full of perspective and wisdom.

DeleteWe have a ton to be grateful for. Sincerely, thank you for reminding me of that.

Your spending looks around the same as ours, although we spend a little more on housing costs right now, I expect your 2017 expense report will look very similar to ours. Instead of a dog we have a baby though - very similar IQ and behaviour at this stage of her life though haha.

ReplyDeleteI think you can come in at under 40k with just a small amount of attention paid back to our old friend frugality.

Saying that it seems a rather arbitrary target and as I'm sure I've said before you will be making money somehow when you reach ER, I can all but guarantee that. So if your nest egg only covers say 38k at 4% then you'll be fine spending say 43k as surely will end up earning 5k a year on average just by messing about doing some stuff you find fun.

Good luck for 2017, I always enjoy reading your financial updates as I think we have the same mindset on spending.

I suspect your baby is already far smarter than our puppy, and it's all downhill from here, too. While your progeny is learning to speak, ours will still be jumping onto guests when they enter our house despite our commands...

DeleteI really do hope we can get under $40k with the new mortgage, but the proof will be in the pudding. I think travel will certainly need to be curtailed for this to happen.

And as you noted, we can probably waver around $40k so long as it averges out in the end. Need to remind myself that this is how data works: it's lumpy.