We're told never to bury the lede, so here it is. We are giving away two audio copies of Jim Collins' excellent book, The Simple Path to Wealth. This is my favorite personal finance book, by far, and you can read why here.

We're told never to bury the lede, so here it is. We are giving away two audio copies of Jim Collins' excellent book, The Simple Path to Wealth. This is my favorite personal finance book, by far, and you can read why here.

But if you haven't read Jim's book, let me tell you, friend: you are tempting fate. I know people who haven't read The Simple Path to Wealth, and they are universally unhappy people: unlucky in board games and in love, terrible dressers with ill-fitting clothes hanging off their slumped shoulders, and while I do not have any firm proof, I'm fairly certain that they are all underwhelming in the sack.

But with a little luck, by next week they could be listening to Jim's book, fixing both their finances and their bedroom shortcomings in one fell swoop.

Plus, you don't have to follow me on Twitter or Facebook to win a copy, either. All you have to do is make me laugh.

One copy will be given to the commenter with funniest reason they should get a copy. Plan on playing the audio book to your dog, laying treats on paper plates with different stock symbols written on them, and then seeing which ones he picks? Sounds like fun to me. Are you going to host a party where, instead of music, Jim Collins' dulcet tones will be played for your guests for three hours straight, with no explanation whatsoever? Awesome.

The other copy, because I suppose things like merit count, will be given to the person who has a legitimately good reason. Like if you or someone you know wants to, I don't know, learn how to be better with their money or something.

But enough about that. You didn't come here to actually learn or improve your situation. You came here to peek behind the curtains at our annual spending. So here it is, you dirty little voyeur, you.

2017 Spend

Non-Mortgage Spend: $35,164

2017 Annual Spend: $48,392

2017 Annual Spend: $48,392

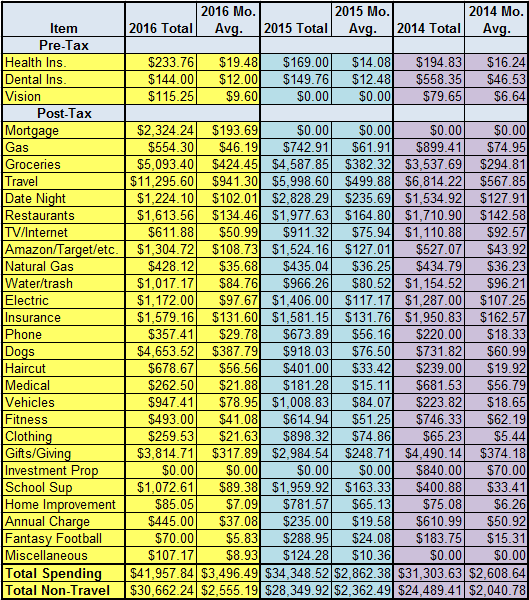

For some context, here is a multi-year snapshot of what we've spent in the prior three years.

What are the big takeaways?

- Spending shot way up in 2017: over $6k in additional spending, and there's a trend of the same going back to 2014. The simple analysis points to the fact that we had no mortgage at all in those early years (and only the last couple months of 2016). Then, we went from having a very small mortgage of $600 on our old house, to a new, big-ass mortgage of nearly $1,500 now.

- Speaking of housing, we spent over $7,000 on appliances, furniture, and other related stuff getting settled in the new home. Let's hope this doesn't repeat every year.

- Travel costs were way down last year, going from over $11k in 2016 to just over $4k in 2017. Considering we traveled to pricey Northern Europe and Asia last year, I'm pleasantly surprised. Maybe we're getting better at travel hacking.

- The pups costs us $2,500 last year, and that somehow was over $2,000 less than we'd spent on them in 2016. I think we're just being overly cautious since Pepper died, paying for every possible test and treatment any time something seems wrong with the pups.

- We spent $2,600 on gifts, but gave under $800 to charities. Something is wrong here...which if I'm being honest, is probably why I combined the two categories in prior years. I know it's a problem, and one we'll have to correct in 2018.

Enough with the past. How is 2018 looking?

So we have a new goal of getting our spending back to $40,000 annually this year, despite more than doubling our mortgage and adding a little one to our family. But we have a secret weapon: jars of cash. Now that we're a month in, how are we doing?

January Total Spend: $4,964

Non-Mortgage Spend: $3,489

Projected 2018 Spend: $59,568

So we're only trending to miss our goal by 50%. #winning

The big outlier in January was my surgery. If we take that out, our spending is a much more manageable $3,578. Still: when we're aiming for an annual target, you can't take anything out, not even the one-offs. If we're going to hit our goal, we'll have to find a way to come in under the $3,333 monthly average for much of the year.

Maybe Jim Collins can write another book, showing me the simple path to keeping my spending in budget.

Or maybe I just need to re-read that first book.

Well, that's enough for today. Let's hear it in the comments: why should you get a copy of The Simple Path to Wealth? Make with the funny, people.

Glad I read the book already! I'd had to fail in bed! lol! Man pets cost a fortune don't they, especially as they get older. Of course you have a pup. Hopefully those middle years will be more financially stable in the dog dept. Your mortgage is my rent for a 1-bedroom. I'm gonna go cry now.

ReplyDeleteI had a feeling just by knowing you, Tonya, that you'd already read the book. :)

DeletePet costs do add up quite a bit if you're 'doing all the things': heartguard, keeping up on vaccinations, regular visits. And our older dog is now on pain medication, probably for the rest of his life. It adds up!

And thanks for the reminder of SoCal rent. We were paying nearly a grand for a bedroom in a house, with three roommates sharing the one bathroom. At least it had a tiny yard for the pups!

I actually already won the audiobook from someone else's blog. Have to say, I'm still a terrible dresser. And I did listen to the book - I guess how to dress properly was hidden in the chapter I skipped (which involved how to live off your investments, something I don't need for a long while yet).

ReplyDeleteI think the wardrobe improvement takes a while to take in. At least that's what the data show.

DeleteOK... my favorite personal finance book will seriously date me - Your Money or Your Life... the original, from way back in the dark ages. Anyhow, I have nothing to make you laugh, nor any real need for the book, but I do think it's hilarious that you have a whole separate line item for Fantasy Football.

ReplyDeleteI love Your Money or Your Life, ECL. Fun fact: it's secretly snuck in to the movie American Beauty.

DeleteAnd yes, we have a separate line item for Fantasy Football. This is the first year in a long while that I didn't end up making money on it. For what it's worth, I also include our NFL Sunday Ticket subscription in there, so that ups the total annual costs.

A woman gets on a bus holding a baby in her arms. The bus driver looks over at the baby and says "Oh my gosh, that is the UGLIEST baby I have ever seen!" The woman is in shock as she makes her way to sit down. She sits next to an elderly gentleman. Once she gathers herself, she tells the elderly gentleman "That bus driver just insulted me!"

ReplyDeleteThe elderly gentleman exclaimed "Well, I wouldn't stand for that if I were you! You should go give him a piece of your mind! Go ahead! Here, I'll hold your pet monkey for you."

Also I should win the audiobook because none of the other commenters seem to want it.

Ha! I think you're currently in the lead, Rick. Let's see if it holds up.

DeleteAnd I've always wanted a pet monkey. Thanks for the laugh!

Is it rational to feel somewhat justified in expanding my housing costs because I don't have pets or a fantasy football interest? Like...those line items are already zero on my budget, so I've got this whole mess under control. The audiobook party sounds like what I do every Friday night, just solo...so maybe getting better in the sack is what I need? I'll take that chapter and I'm hoping there's a follow-up chapter on landing a man who has already read and implemented the book with great success. Is that doable?

ReplyDeleteHa! Hell yes you're justified in spending more on housing if there are no pups or fantasy football. That's a couple thousand dollars every year, easy.

DeleteI can imagine the ruckus in the FIRE forums if you posted that you were looking for a guy who's read and implemented the lessons of Jim's book, and were working on getting better in the sack, to boot.

My 2 year old daughter is having night terrors (fear, screaming, and erratic behavior about our hair on FIRE spending) and the audio book is just the thing for soothing her to sleep WHILE having magical dreams about finances. Who needs a white noise machine? That's why Jim Collins wrote this book, right?

ReplyDeleteHa! First, sorry that the blog's AI thought you were spamming me with the comments. And second, thanks for the laugh!

DeleteHi Shannon! You made me laugh the hardest so you win the audio copy of Jim's book. Email me at donebyforty at gmail dot com and I'll send you the code.

DeleteDBF, you've been stuck in my spam folder! Hope it smelled ok and sorry for not getting you out sooner.

ReplyDeleteThe other day I went to the ATM and this old woman asked if I could check her balance, so I pushed her over.

If you still have an audiobook to give, I have the meritorious situation. Chatting with my skin-care person and she mentioned CC debt. She'd read some Ramsey and Orman, but had a least heard of Mr. MMM. I gave her homework to read the MMM classics about debt and simple math for retirement. She's ready to hear more about FI and best of all, prefers audiobooks and podcasts.

Ha! I love the ATM joke and am totally stealing that.

DeleteAnd yeah, we totally still have the merit based one and I think you've got it! Shoot me an email at donebyforty at gmail dot com and I'll send you (or her) the code for the audio book.