Financial independence, ironically, becomes less in our control as we get closer to it. More and more is in the hands of the market, while our contributions make up a smaller and smaller portion of the overall portfolio. If the market goes up the next year or so we'll likely hit financial independence in my fortieth year without much problem.

If the stock market dips hard, then there's literally nothing we can do to make up for it. Those are the breaks.

As someone with a lot of control issues, having so much out of my control is a weird, unnerving feeling.

It's also a feeling I need to get comfortable with since that's going to be our normal state of being once we stop working and everything relies on the thousands of companies and governments that comprise our investments. We've got a few decades of things being out of my hands and in those of the market, so I better get used to it.

One thing that is in our control, at least in most respects, is our spending. We recently paid off the mortgage to keep our spending artificially low. And now, with the exceptions of our property taxes, a couple insurance policies, and our utilities, I suppose you could say that all our spending is discretionary. It's all up to us.

We can decide to eat in more or eat out. We can decide to buy a new car (and the expenses that come with it), or we can continue rocking our 2006 Matrix and stay a one car family. We can take two trips this year, or none at all.

And our spending obviously is a big determinant for our financial independence plans. The amount we choose to spend basically determines the target for our nest egg. In our case, we take our annual spending, account for changes that will happen after we leave work like health insurance, and then divide that amount by 3.5% to get our target FI figure.

The big decision that we're working through now is how to handle daycare as an expense. It's in our annual spending now, and it's a big line item: roughly $1,000 a month. Our plan is to have a second baby (the yet-to-be-named MC Baby) prior to pulling the trigger on FIRE, and that would send our daycare costs even higher.

But our plan after leaving full time work was not to continue with putting the littles in daycare if we're both not working: we'd watch them instead. There are two of us so that would make things easier than if just one of us had to take on that labor.

But time with family is also the main reason we're even working towards financial independence. Baby AF will be in school before we know it. We'd like to get more than the time we get right now with him before and after work, and on the weekends.

Still, plans change. With us, they change a lot. After a year of family bliss in early retirement, we might see the benefits of some daycare.

That still leaves us with a bit of a decision on how to account for an expense we have in our budget right now, but one that we don't plan on having later...but definitely could have later because we cannot predict the future.

Let's look at some graphs and see if numbers help us come to a decision.

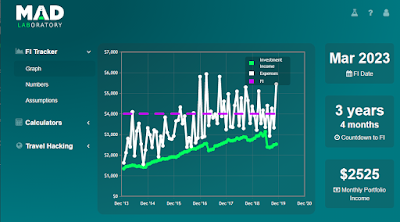

Here is when the Mad Fientist's laboratory projects we'll hit financial independence under our current plan, under a 3.5% withdrawal rate and assuming a $36k annual spend that doesn't include daycare, and does not include a mortgage (which was only true for monthly budgets after August 2019, following the white line on the graph).

|

| Click for bigness |

But what would our date for financial independence look like if we wanted to budget for $1,000 of daycare going forward? Even if they're not in daycare, there could be kid-related expenses that end up in that range...right?

Let's take a look at what happens to our plans if we increase our monthly spending by *checks notes* a ridiculous thirty three percent.

|

| Click for bigness |

Dear God, that is a lot longer. Done by Forty-Two doesn't have quite the same ring to it. We'd have to work for an additional two years and two months to cover just daycare.

Somewhat ironically, Baby AF would probably be too old for daycare by the time we'd saved up enough for him to attend.

And that's the rub. Adding an extra thousand dollars a month to our budget is such a big change that we'd have to save up an additional $343k just to cover it.

When we think of the small fortune we'd have to amass to get the benefits of daycare, it it worth the effort? Is it worth the time?

My gut says, no. That juice is not worth the squeeze. While we'll be the first to admit that there are a lot of nice benefits to daycare, I'm not sure I'd work an additional two plus years and save up an additional three hundred and forty three thousand dollars, just to get the benefits of daycare.

What I can imagine us doing is finding some sort of post-financial independence work that we just enjoy doing for its own sake, and sending the kiddos to daycare because, well, they're kids and someone needs to watch them. While this isn't what we think will happen now, I can definitely imagine a reality where we (or at least one of us) would like to give some new, interesting work a shot.

But I also think we'd probably give staying at home with the kids a shot first. That we'd try early retirement on for size, see how it felt. Maybe we'd love this next life of ours, filled with day trips with the kids and board games and going for hikes around our little state.

Or maybe we'd get them back into the care of professionals as soon as we could.

I wish there was some way to know how future Brian would feel about all this stuff. How can we budget for a future that might be drastically different than our present?

If we budget for the big expense, that will cost us a lot of time and money. If we leave work too early and find out we need daycare, then we may need to work again, sacrificing the early retirement itself just to pay for it. It's a dilemma.

As always, I have no answers. I have some spreadsheets and some scenarios, but no way of knowing which will match our reality.

I hate to say we're going to have to wing it, because these are big decisions with price tags to match. But without a way to see what's coming around the corner, I think we'll just have to keep on this path and see what future we run into when we get there.

As always, thanks for reading.

*Photo is from kidsworkchicago at Flickr Creative Commons.

**Having trouble leaving comments? Blogger's comments require cookies from third parties, which your browser may block (especially if you use Safari). You can change your settings here:

Another way of looking at daycare is as a one-time expense....so if you need 8 years of daycare in total between the two kids (for example, obviously dependent on when you start them in daycare), you actually only need 8 x $12,000 = $96,000.

ReplyDeleteA lot of my friends who stay at home have their kids in daycare sometimes as a way to maintain an adult life as well as their sanity.

I love that framing, Frugalish! And it's a much more reasonable number: one we can maybe hit in our timeframe for FI, too.

DeleteMrs. Done by Forty and I can make a new graph now. :)

"Done by Forty-Two" - May I point out that it has a nice Douglas Adams ring to it?

ReplyDeleteI feel so much in the same boat as you with knowing that I can't know how I will feel about doing something totally and completely different from what I'm doing now, particularly because sometimes I'm surprised and love it and other times I'm surprised and hate it. It'd be awfully nice to know some things for sure, dangit!

But I also make myself really unhinged trying to cover every contingency as well and that's no good.

Hey there, Revanche!

DeleteI think we both are people who like to have all the bases covered, just in case. I don't think I'm doing my due diligence unless I do.

Still, FIRE is proving to be one of those tough-for-me scenarios where the closer I get to the goal, the more uncertainty there is in my situation. It's unnerving.

That whole “depending on the market” is the part that scares me most about retirement. Right now I’m in the “we can always make more money if we need to” mindset which makes me less worried about money.

ReplyDeleteI’m thinking you may want at least a little bit of daycare for the kids so you two can rest and spend time with each other and your kid(s) will still get benefit of social interactions. But yeah, it’s tricky to weigh out how much you value the earlier vs slightly delayed retirement.

Agreed, Stepahnie. Depending on the market entirely is a scary feeling now, and it's going to only be worse when money from our paychecks stops coming in.

DeleteI agree that at least SOME money for daycare is probably a worthwhile goal. Maybe I should run another scenario where we budget half of that amount for some part time daycare or preschool.

I suspect that the rub will be whether or not we want to trade another year or two of work for that.

This topic always reminds me what a gift we had (despite the irritations) of having my mother-in-law live with us the first four years of my kid's life. That is a HUGE financial advantage. We still used daycare, but much more sparingly.

ReplyDeleteLooking forward, we plan to do the same for our own grandkid(s) and not check out (as some do) into our own personal travel/retirement isolated "island". In this day and age, other than paying for college, I can think of no better gift parents can do for their kids than helping them with their own childcare.

Pro tip: donebyforties.com is, as of this morning, still available. Go grab it. Of course, that would be an additional discretionary expense...

Hey there, Tin!

DeleteI sometimes wonder if I should go get other site names. I think I'll stick with the original and just laugh about it if we miss the target.

I agree that having family help the first few years is a huge advantage. The costs of daycare, especially for more than one kid, are just astronomical for the quality facilities.

Agree that we have to watch out for being too isolated in retirement. That's a big risk, probably the main one. And spending time with family can be a win-win, saving on costs for care while also getting quality time in. Smart idea there, Tin.

I'd say there a lot of other options. What if one of you FIRE'd to stay home with the kids, saving $2,000 a month, thus reducing the expense, but still having one income.

ReplyDeleteCould either of you work from home or work 10 hour shifts 4 days a week? This would save 1 day or potential multiple days of daycare, thus reducing the amount.

What if you just upped your FIRE percent to 4% and then did some side hustling after retirement to make up any shortfall? Half a percent in a side hustle for you would be like what $180 a month???

Seems like there are a lot of ways to make it work without sacrificing 3-5 extra years in the job force. FIRE asap and spend that time with your kids. You won't regret it!

Well I don't think the delta is three to five years (the charts show two years and two month), and half a percent on SWR would be quite a lot more than what you're estimating. But I think I hear what you're saying.

DeleteWe've certainly talked about one of us working full time and one of us staying home with the kids, but the kind of FI life we're imagining doesn't mesh well with that.

Thanks for stopping by.

I retired when our son was 18 months old. We started him in preschool about a year later.

ReplyDelete2 years old - 2 days/week.

3 yrs old - 3 days/week.

4 yrs old - 4 days/week.

5 yrs old - full time kindergarten at our public school.

Luckily, there are flexible programs in our area so it was too expensive. The preschool was good for our son.

Sorry for the late reply, Joe.

DeleteI like that scale that you've drawn up and we could certainly budget around that, or something similar. Preschool has some options around us that we could look at, too. Thanks for that idea!

Try not to overthink this my friend. The balance will reveal itself. I'd argue that if you can't dedicate one parent being home full time through age 5 (leading up to Kindergarten) try at least half time. Consider day care to cover the rest, or a nanny.

ReplyDeleteThis worked amazingly well for us and left no regrets about time spent during those pre-K years. Now that the twins are off to the races and in school all day long, we embrace the evenings and weekends for bonding. Mrs. Cubert volunteers in their classrooms twice a week for a little extra "air time".

Best as you make your calculations my friend. Good thing is if one of you retires early, the childcare problem is solved right off the bat.

That's a good approach, Cubert. I think the rub for us is that the thing you're describing (one person working, one at home with the kids) is complicated if I'm also the one working at home. We did that the last year and it had some plusses and minuses. Maybe an office space outside the home, even part time, would be an option.

DeleteAs you said though, some of this we'll have to just roll with and hope the balance reveals itself. The catch is that we have to save up the money ahead of time for whatever that balance costs: this is proving a hard nut to crack, financially.

A topic close to my heart.

ReplyDeleteI would suggest that focusing on the time added to FI is one way of looking at the cost but what about the value of the childcare - what are your kids (or loss centres if you think like a CEO) getting from it?

We've done full time SAHM, full time nanny and now full time nursery/daycare. All have their advantages (and costs).

It's a necessary evil and you can see why for many people moving "closer to family" becomes important - finding safe, reliable, caring and nurturing childcare on the cheap ain't easy!

Well said, Gentleman. And thanks for stopping by!

DeleteThere's certainly a benefit from childcare/preschool that we should figure in, as you said. Everything has an opportunity cost, no doubt.

We unfortunately/fortunately don't have family close. So while we don't get that free labor, erm, childcare, at our disposal, we also enjoy the benefits of having the grandparents a suitable distance away.

We are in the same boat.

DeleteThe reason so many families move back home is because of this huge cost

"Closer to family" is just $$$$ in many cases.

Or maybe somethings are more important.

Very insightful, I must say! btw finding a skilled Diesel pick up truck mechanic in Texas is essential for keeping your truck running smoothly.

ReplyDelete